McCarthy & Cox News and Articles

Press Release | August 21,2023

McCarthy & Cox Charity Outing a Success

The 11th annual McCarthy & Cox Charity Golf Outing was a giant success, breaking a previous record and raising $27,670 for two charities! “We are very thankful for the outstanding turnout and support from our community and corporate sponsors,” commented Jim Cox, Managing Partner of McCarthy & Cox.

“Tom McCarthy and I started the McCarthy & Cox Cares Fund in 2013 to assist seniors, youth, and to fill emergency needs in Union County. To date, the Fund has donated more than $67,000 back to our community. The Cares Board manages the grants and consists of five current McCarthy & Cox clients who independently review requests from the community. For more information or to apply for funds, we encourage people visit McCarthyandCoxCares.com,” Cox shared.

“The Elizavèta Fund also benefits from our annual golf outing, which Jim and Faye Cox founded in 2014 to assist families with the financial burden of adoption costs. Jim and Faye adopted their daughter, Caroline Elizavèta, from Russia in 2011. Throughout their adoption process, they came to realize the financial and time commitment that is required and decided to help others who wanted to grow their families in the same way. Over the years, the Elizavèta Fund has granted nearly $80,000 to assist 17 families, aiding in the adoption of 22 children. For more information, visit ElizavetaFund.org,” McCarthy noted.

Both funds are housed at the Union County Foundation and donations are tax deductible.

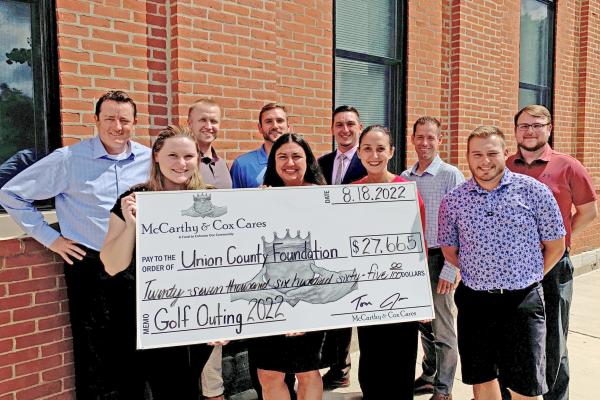

Press Release | August 23, 2022

McCarthy & Cox Charity Outing a Success

The 10th annual McCarthy & Cox Charity Golf Outing was an enormous success, raising a record $27,665 for two charities! “We are very thankful for the outstanding turnout and support from our community and corporate sponsors,” commented Jim Cox, Managing Partner of McCarthy & Cox.

“Tom McCarthy and I started the McCarthy & Cox Cares Fund in 2013 to assist seniors, youth, and to fill emergency needs in Union County. To date, the Fund has donated more than $55,000 back into our community. The Cares Board manages the grants and consists of five current McCarthy & Cox clients who independently review requests from the community. For more information or to apply, we encourage people visit McCarthyandCoxCares.com,” Cox shared.

“The Elizavèta Fund also benefits from our annual golf outing, which Jim and Faye Cox founded in 2014 to assist families with the financial burden of adoption costs. Jim and Faye adopted their daughter, Caroline Elizavèta, from Russia in 2011. Throughout their adoption process, they came to realize the financial and time commitment that is required and decided to help others who wanted to grow their families in the same way. Over the years, the Elizavèta Fund has granted nearly $75,000 to assist 17 families, aiding in the adoption of 22 children. For more information, visit ElizavetaFund.org,” McCarthy noted.

Both funds are housed at the Union County Foundation and donations are tax deductible.

When Pristine Becomes Too Pristine

Written by Wesley W. Bean, CFA®

When I began thinking about this piece in late 2021, the word that kept coming to mind when thinking about the economic backdrop was “pristine”. However, there’s a point where “pristine” becomes too “pristine”, and market participants turn their attention to what needs to be done to slow it.

Fast forward a few weeks, and that’s where we are now. As I write this, the S&P 500 is off a little over 7% year-to-date. The Dow Jones Industrial Average is faring slightly better, off just 5%, while the tech-heavy Nasdaq is off by 11%. Look beneath the surface, however, and you’ll find more than 220 US large-cap names off over 20%, and nearly 40% of the names in the Nasdaq Composite have seen their share price cut in half.

So, with an economy that continues to grow, a central bank that has turned its attention to slowing it, and the continued backdrop of Covid-19, what’s an investor to do? Sit tight? Sell and go to cash? Buy more?

Our outlook for the remainder of the year centers around the transition to a period of slower growth, namely, how policymakers will navigate the waters, and how the markets may react.

We currently have several tailwinds, one of which is continued policy support. Quick, significant, and globally coordinated fiscal and monetary stimulus was delivered early in the pandemic and maintained throughout. This served as a powerful force in propping up economies and staving off a financial crisis.

Now, however, central banks are paring back these emergency measures. In the US, the Fed has slowed the rate it injects money into the economy (tapering) and started the rhetoric around interest rate hikes. Higher inflation seems to have forced the Fed to act sooner than initially planned, but we should keep in mind that any Fed rate hikes are coming from zero. This is still a supportive backdrop for stocks.

There is still an incredible amount of pent-up demand among consumers, another tailwind for both the economy and financial markets. Consumers built up savings during the lockdown, and the reopening spurred a robust activity restart and a vigorous spending cycle. Although we are past the initial swell, there is likely additional spending coming as we transition to an endemic state.

While some of this cash made its way to the financial markets, there are still near-record levels sitting on the sidelines, held by both businesses and individuals. Companies began to spend in 2021 in the form of dividends and share buybacks - nearly half of dividend payers in the Russell 1000 Index raised or initiated a dividend last year - and there are even better prospects for 2022. This leads us to look for quality companies with strong balance sheets and lots of free cash flow; those that are best positioned to return capital to shareholders and weather any storms.

Lastly, households are in good financial shape. Income statements and balance sheets are solid. Unemployment is down and wages are up. Even if rates rise, most of consumers' big payments are fixed in the form of mortgages or auto payments. Impacts to credit card payments would be minimal should we see only a handful of rate hikes.

On the flip side, we have several headwinds. The identification of the omicron variant in late November, and the market's strong immediate reaction to it, was a stark reminder that Covid-19 remains a risk. Although we now have multiple vaccinations, booster shots, and treatment options, when new variants emerge, cases and hospitalizations spike. Undoubtedly, this will continue to hang over consumer behavior and potential consumption patterns, but market reactions have and should continue to diminish over time. From an economic standpoint, any new variants of the Covid virus should be manageable and temporary. There will continue to be people that choose to not vaccinate, but the trend has been to ask them to wear masks, and the government has no intention of shutting down businesses again. However, for the near future, the markets will worry when, not if, new strains will appear and where.

According to data from the CDC, the flu shot many of us get annually reduces the risk of illness by between 40% and 60%. The specific strains of virus chosen for the seasonal flu vaccine are selected each year based on forecasts about which ones are the most likely to circulate during the coming season. Although the flu shot may not prevent all cases of influenza, it will help protect you from severe infection and death and can help reduce the spread of the virus in communities. Covid vaccines are no different in this respect, and vaccines can quickly be adapted as the virus evolves which bodes well going forward.

Geopolitical tensions between the U.S., China, and Russia are running high. It’s likely that none of the individual issues on a stand-alone basis would have a significant impact on the global economy, but the potential remains for an escalation of events that could. This would most certainly become a headwind if it were to have a disruptive effect on global growth.

I’m the first to admit when I’m wrong, and when it comes to inflation, I was wrong. I was in the “transitory” camp, even though we truly never knew what “transitory” meant. Fed Chair Powell recently stated the word “transitory” should be retired, and I agree. It’s time we admit some of the inflationary pressures have overstayed their welcome, and we can describe inflation as something other than “transitory”. This, along with the Fed’s planned policy normalization, will likely be the single biggest issue that shapes the markets in 2022.

During and after the housing crisis, there was too much to buy but not enough people that wanted to buy. In the early stages of the pandemic, this was also the case. As the economy shut down however, production stopped in the vast majority of goods and services, so things balanced out. As economies reopened, people wanted to buy again, but companies couldn’t produce enough fast enough.

A good example of this is rental cars. A majority of auto rentals occur at airports. When lockdowns first occurred, there were fewer people flying, which meant fewer people needed to rent cars. A car parked in an airport garage represents a cost to rental car companies, and with no demand, they sold off their cars to cut expenses. When travel resumed, rental companies were scrambling to replenish their supply. This led to a spike in demand at the same time the supply chain issues began occurring, which included chips and other automobile components. To see the result, all you need to do is try and rent a car this weekend. If you can find one, you’ll likely pay double what it would have cost pre-pandemic.

Demand surged in many areas after the vaccines were developed, and people wanted to go out to eat again, go to the theatre, go shopping, and get back to life as normal. But in many cases, supply chains couldn’t keep up. We’ve had all sorts of shipping and logistical delays across the globe. Many US ports are at a disadvantage compared to those globally because they have not yet embraced robotics and automation. As a result, it can take twice as long to unload a ship domestically as it does elsewhere. This, along with the increased demand, pushed prices higher.

And while much of the world has learned to live with Covid, China continues to shut down factories, or even cities, when the virus is detected. This will likely lead to ongoing supply chain issues with goods coming from China.

So, how long will inflation persist? It depends. If you’re doing anything other than going to Disney World, buying a used car, or filling your car with gas, it may already be over. If you’re renting a car at the airport, it may be a while. Either way, higher input costs will either be absorbed by business, passed along to customers, or a combination of the two. So far, businesses have been able to pass costs alone and consumer spending hasn’t slowed. Eventually they may, however, and companies will have to lower prices, squeezing profit margins. The only certainty around inflation is that it’s been more than transitory.

Speaking of transitory, Jerome Powell has been one of the most transparent Fed Chairs in history. And, given the market often reacts to unexpected Fed measures rather than the actions themselves, we appear to be in good hands. That said, just a week after he was nominated for a second term as Federal Reserve chairman, Jerome Powell sounded unfamiliar to some. He said it was time to retire the word “transitory” that he and many other officials have long used to describe building inflation, signaling in testimony before the Senate Banking Committee that the Fed is likely to accelerate the tapering of its emergency bond-buying program. That suggests rate increases might come sooner than planned.

Why the sudden change? It’s important to remember that the Federal Reserve has a dual mandate: to maintain price stability (inflation) and full employment. The price stability mandate likely doesn’t look so good to Powell right now, and he simply indicated this has become the bigger concern. Additionally, it’s becoming increasingly apparent the Fed has been behind the curve on inflation and wants to move to catch up before it’s too late. Powell has this flexibility now that he’s secured the second-term nomination.

The market, as represented by the Fed Funds rate, is pricing in three to four interest rate hikes in 2022. And although it seems too early to extrapolate rate hikes given the uncertainty around the evolution of the Covid virus, a year-end Fed Funds rate of around 1% doesn’t seem unreasonable. Should economic conditions deteriorate, we would expect the Fed to reevaluate.

While rising rates equate to falling bond prices, there are several factors that may serve as a cap on rates, and thus a floor on prices. With global populations aging and savings rates high, there is strong demand for long term bonds. Insurance companies and pension funds continue to purchase long-term US bonds to meet long-term liabilities because their yields are still higher than those in most other major countries. Additionally, the US is likely to issue less Treasury debt compared to last year, which should take some of the upward pressure off of yields.

On the equity side, historically, equity market returns have been robust in the 12 months prior to, and 36 months post, the first interest rate hike. So, even though we’re likely near the beginning of a tightening cycle, history tells us it’s not all doom and gloom. But anytime the Fed takes (or doesn’t take) action, there is a risk of a misstep. On one hand, tighten too slowly and inflation will likely grind higher. On the other hand, tighten too quickly and the economy could plummet into a recession.

Given this backdrop, the question becomes, how will 2022 play out?

2020 brought mainstream the use of the word “unprecedented” and 2021 gave us “transitory”. We need a word for 2022.

After the quickest bear market and subsequent recovery in history, we are now at a point where things are continuing to improve, but at a slower pace. A slowing recovery if you will, but I’m not particularly fond of using the word “slowing” at every investment committee meeting throughout 2022.

To convalesce means “to recover health and strength gradually after sickness or weakness”. This seems particularly relevant in describing the current state of our economy. So, let’s call this phase of the recovery convalescent.

Even though it’s slowing, we still expect growth in the coming quarters. For 2022, global GDP is likely to rise by 4-5%, which is less than 2021, but still nearly double the historical average. The economy is still expanding, unemployment is down, jobs are abundant, and consumers and businesses are confident about the future. Many economists agree the good times have some staying power.

So how do we take advantage of this? US equity market valuations are lofty, no doubt, particularly large cap growth stocks. Robert Shiller, a Nobel Laureate economist, cites a measure he created, the Cyclically Adjusted Price Earnings Ratio (CAPE). This ratio stands at a level that is only surpassed by the height of the measure reached in 2000, just before the stock market crash. This ratio can’t be used as a reliable predictor because it says nothing about the timing; it just tells us that valuations are rich. That is, although the CAPE is nearing an all-time high, stock prices may continue to climb throughout 2022.

Look a little closer, however, and you can quickly see valuations are most elevated within the US large cap growth space, particularly the largest 5-10 companies. For relative value, we’ll need to look to other areas of the market: value stocks versus their growth counterparts, smaller companies, and companies outside the US.

Many value stocks possess strong balance sheets, and these quality companies may better withstand any hiccups that should occur. International stocks’ fundamentals are improving, and the valuation gap between international and US equities continues to widen providing another source of relative value. Further, relative to the US, international stocks are overweight value names. Additionally, should interest rates rise as expected, value companies typically have cash flows that are received sooner than their growth counterparts, so they have a less violent selloff. Also, value stocks have performed particularly well in moderate-inflation environments, another factor that should favor the asset class.

Before we conclude, there’s one last thing we should be asking ourselves. While inflation is a concern, no one has been talking about the possibility of deflation, particularly as we look past 2022. Should we be paying more attention to this?

Covid wreaked havoc on supply chains, and we are currently seeing the resulting inflationary pressures. However, it also accelerated innovation. You have to go back to the times of the telephone, electricity, and the automobile to see as many major innovative themes evolving at the same time as we see today: DNA sequencing, robotics, energy storage, artificial intelligence and blockchain technology. These should lead to productivity gains of magnitudes not previously experienced. And since GDP is the product of hours worked times productivity, increases in productivity can boost GDP even if hours worked declines. In other words, innovation and technology that lead to productivity gains have the potential to boost GDP without the full complement of workers. Today, we have more jobs than workers – leading to higher wages - but as productivity increases, we will need fewer workers for the same amount of output, reducing costs.

The primary takeaways around inflation are this: Covid was initially deflationary as we shut the global economies down; it became inflationary as we reopened. Innovation is deflationary over the longer term, and it’s accelerating at rates not seen since the early 20th century. And regardless, inflation is a sign of a healthy economy, and stocks perform well during times of moderate inflation, particularly value stocks.

Wrapping this up, while we expect less impressive returns for risky assets in 2022, they should continue to climb. We have an ideal economic backdrop, accommodative policies, and near-record amounts of sidelined cash. And with bond yields that still hover near historic lows, we also have the TINA (There Is No Alternative) effect. We do have headwinds, primarily inflationary pressures, and the Fed’s response to it.

Trying to put a number on “less impressive returns”, strategists at Wall Street firms have a year-end target on the S&P 500 of 5,000-5,050, which implied returns in the neighborhood of 5%. Given the recent pullback and using the same year-end target, this number is now closer to 15%, but may be revised downward as analysts reassess.

Our tactical asset allocation views for 2022 are as follows:

- We maintain a preference for stocks over bonds, particularly quality companies with strong balance sheets.

- We favor value stocks over their growth counterparts.

- We will look to add to our international exposure, especially developed markets.

- We will seek to increase exposure to small cap stocks should the opportunity arise.

Predicting what financial markets will do in the coming year is tough at best. Whatever happens, there will always be bumps in the road over the shorter-term. However, longer-term, we have confidence in the trajectory of the global economies, which turn should push global financial markets higher. As a result, we must be prepared for these bumps in the short term in order to benefit from them in the long run.

https://www.wsj.com/articles/giant-stock-swings-kick-off-2022-11642351304